This is the second of a four-part series covering what is needed to best determine how to allocate one’s assets. As we wrote before, we allocate assets based upon an understanding of one’s current and future financial resources, tolerance for risk, and financial goals.

Collecting current financial resources is the first step in organizing and centralizing one’s financial, tax, and estate matters. The greater the complexity of one’s financial affairs, the lengthier the process. This tends to be a rewarding endeavor as this information provides a starting point from which we can assess current financial standing and progress towards goals in many years to follow.

Assets & Liabilities

The goal here is to establish an inventory of all assets and liabilities, which include:

-

Current assets – checking and savings accounts

-

Investment assets – brokerage accounts, liquid or illiquid investment holdings

-

Business assets – equity of business interests in operating companies, partnerships, LLC’s, corporations

-

Retirement assets – retirement accounts

-

Real estate assets – primary and secondary home values

-

Personal assets – jewelry, furniture, collectibles, vehicles

-

Liabilities – including personal, home, vehicle, and credit card debt

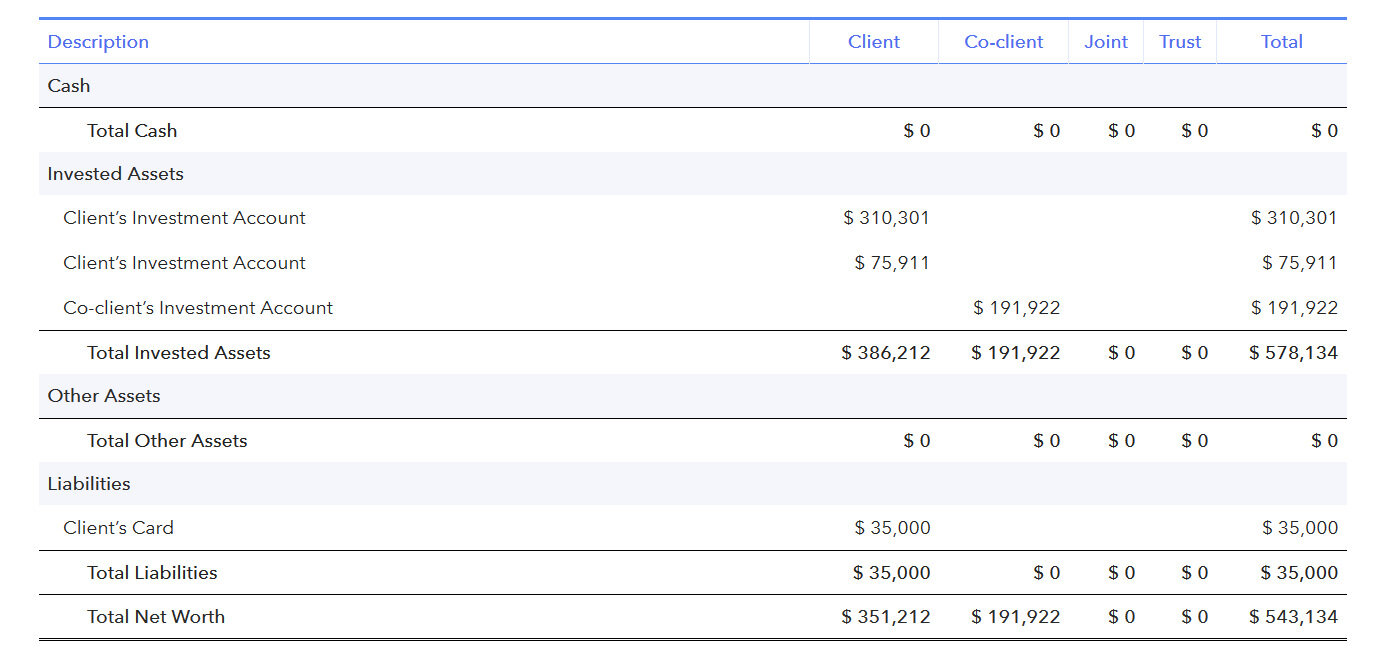

Once we receive the necessary input from our clients, a net worth statement is prepared to establish a base line of current financial position.

A sample net worth statement is illustrated below:

The statement of net worth tends to be one of our ‘measures’ as clients progress towards their goals. With Iowa City being home to a large – and well-respected – academic institution and teaching hospital, education debt may be more common than other locales if measured on a per capita basis. As a result, a young professional beginning their medical career, for example, may have a negative statement of net worth. More on this shortly, but this tends to be short lived as cash flows substantiate the purpose of debt. In short, the return on one’s investment in education becomes realized through higher levels of income.

Additionally, as we do a deep dive into one’s resources, we tend to arrive at a sense of one’s level of financial sophistication, utilization of debt and equity, and sense of financial preferences.

Human Capital

Often neglected, yet very important, is the assessment of human capital. When quantified, human capital is the present value of one’s future wages. When you’re young, this is likely the most valuable ‘asset’ you own and often not included as part of your net worth as it is not a ‘financial asset’. If it were included in one’s net worth, the present value of one’s human capital is likely more significant at the onset of their career. Illustrated in the chart below, is the value of human capital and financial assets over the average career:

We often use the present value of human capital to assess the need to insure against the loss or marginalization of earnings power through disability or death and to assist in determining the appropriate amount of insurance coverage when combined with discussions surrounding financial goals.

When calculating the present value of human capital, we are projecting annual earnings over one’s career and discounting those ‘cash flows’ back to present value. The discount rate applied is subjective in nature and reliant upon the stability or volatility of one’s earnings power. The more stable one’s occupation and earnings, the lower the discount rate. The result of a lower discount rate is a larger present value of human capital when compared to someone with equal earnings over the same number of years, but with greater volatility in earnings.

Additionally, we utilize the value of one’s human capital when determining, in part, the capacity for exposure to risk assets when allocating capital. Keep in mind, however, the element of human capital element only plays a partial role in the allocation of assets.

Household Cash Flows

In addition to capturing one’s current asset and liabilities, we work diligently to understand one’s annual cash flows. Cash flow analysis allows MFG to understand current annual savings, a starting point for understanding potential income needs in retirement, lifestyle costs, debt payments, areas to improve tax efficiencies, and additional savings capacity should cash flows be positive.

Cash flows represent income less expenses and can be categorized as followed:

-

Sources of cash

-

Wages

-

Bonuses

-

Social Security income

-

Business receipts

-

Investment Income

-

Interest from current assets

-

Withdrawal from investment assets

-

Withdrawal from business assets

-

Withdrawal from retirement assets

-

-

Disbursements

-

Lifestyle costs

-

Mortgage & loan payments

-

Education costs

-

Retirement contributions

-

Savings into investment or business assets

-

529 contributions

-

Gifts

-

Other disbursements not included

-

-

Taxation

-

Federal taxes

-

State and local taxes

-

-

Net after-tax cash flow

Cash flow analysis allows us to dig deep and explore areas of opportunity to increase savings, reduce expenditures, paydown or leverage debt, in efforts to optimize one’s financial affairs to meet their goals.

Assembling an Initial Financial Plan

When combined with one’s tolerance for risk and financial goals, we are able to extrapolate the utility and growth of one’s financial resources – be it assets, liabilities or cash flows – to assess the probability one will meet their respective financial goals. We accomplish this by applying various assumptions to our financial models to illustrate probabilities of potential outcomes run through 10,000 sample distributions.

We leverage the input of current and future financial resources to assist in answering our client’s questions and progress. Below are common questions:

-

Can I retire at the age I want to?

-

What income can I expect?

-

Can I replicate my current lifestyle during retirement?

-

Can I fund my kids college and still retire when I want?

-

What do I need to save to acquire a second home in retirement?

A financial plan is never static and should be reviewed periodically to ensure evolving goals are updated, measure progress towards goals, and apply changes to assumptions when and where needed. At MFG, we pride ourselves on providing excellent client service coupled with deep, timely, and relevant financial analysis of one’s entire financial matters – be it estate, financial, tax or otherwise – in efforts to maximize positive outcomes.