A Guide for New University of Iowa Employees

Are you a new employee at the University of Iowa? If so, the decision between IPERS and TIAA for your retirement benefits is a critical one. Let’s navigate this important choice together:

- First, we will provide you with a comprehensive overview of enrolling in University of Iowa retirement benefits, ensuring you have a clear understanding of the process and its significance.

- Next, we will delve into the essential particulars of IPERS, outlining its features, advantages, and considerations. You will gain valuable insights into how IPERS can support your retirement goals.

- Then, we will present the TIAA option, shedding light on its unique benefits and offers. With TIAA’s comprehensive range of retirement solutions, you will discover the advantages it brings to your financial future.

- Lastly, we will provide a framework that will assist you in making an informed decision between IPERS and TIAA. We understand the importance of choosing the right retirement plan tailored to your specific needs, and our goal is to equip you with the necessary tools to make the best choice for your future.

Join us as we navigate the complexities of retirement benefits, empowering you to make a confident and well-informed decision that sets you on the path to a secure and fulfilling retirement.

Overview of University of Iowa retirement benefits

The University of Iowa prioritizes retirement planning for its employees and offers two primary options: TIAA and IPERS. TIAA is a 403(b) plan, similar to a 401(k), while IPERS is the State of Iowa pension program for state employees. Both the employee and the University of Iowa contribute to these plans with each pay period.

As a new employee, you will receive an email with instructions to enroll through the Employee Self Service site. It is crucial to gather information, consider your circumstances, and carefully evaluate the appropriate plan for your retirement needs. By default, employees are enrolled in IPERS unless they actively choose TIAA within 60 days of their hire date.

We want to emphasize the importance of this decision, especially if you intend to have a lengthy career at the University of Iowa. Once you select TIAA, IPERS, or automatically enroll in IPERS after 60 days, your choice becomes irrevocable. You will be unable to participate in the other retirement program during your employment with the University of Iowa.

Now, let’s delve into the specifics of IPERS, TIAA, and provide you with a framework that will help guide your decision-making process. We want to ensure you have all the necessary information to make an informed choice that aligns with your long-term financial goals.

Iowa Public Employees’ Retirement System (IPERS)

The information below is written for ‘Regular’ IPERS participants. ‘Regular’ members make up over 95% of IPERS. The other categories are Sheriff/Deputy membership and Protection Occupation membership.

IPERS is the Iowa Public Employees’ Retirement System. It is a defined-benefit plan (pension) and is the default option for State of Iowa public employees. For new University of Iowa employees, IPERS will be automatically selected after 60 days if TIAA is not selected.

Participants in IPERS contribute 6.29% of their wages to IPERS with a 9.44% contribution from their employer. The contributions are deposited into the IPERS Trust Fund, pooled with all other contributions, and invested across a variety of asset classes such as stocks, bonds, and private equity. The future value of these assets is used to payout benefits to State of Iowa retirees.

An IPERS participant’s pension income in retirement is determined by:

- If the participant is vested (7+ years of service)

- Average of a participants five-highest annual wages

- Total years of service in IPERS

- Early retirement reduction (if applicable)

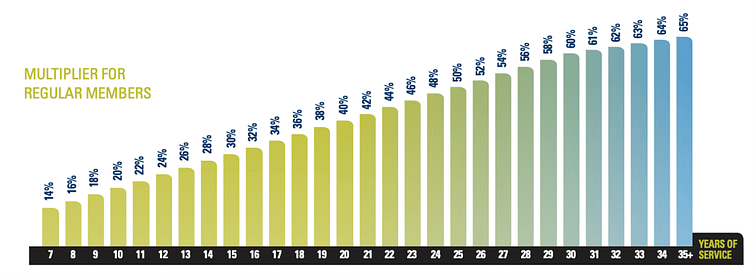

If vested, the annual benefit in retirement equals the highest-five wage years multiplied by a multiplier based on service credits (more below) minus any early retirement reduction, if applicable.

Vested Members

Vested members are eligible for monthly retirement benefits or a lump sum benefit upon retirement. Beginning July 1, 2012, you become a vested member when you accrue seven years (28 quarters) of service or are at least age 65 working in covered employment, whichever occurs first.

Being vested in IPERS offers a range of valuable benefits that significantly enhance your financial security and provide peace of mind for your retirement. Here are the key benefits of being vested in IPERS:

Retirement Benefits: As a vested member, you become eligible for monthly retirement benefits or a lump sum benefit when you retire. These benefits serve as a reliable source of income, ensuring a steady stream of funds to support your post- employment life and maintain a comfortable standard of living.

Disability Benefits: Vested members also qualify for disability benefits. In the unfortunate event of a qualifying disability that prevents you from working, these benefits provide crucial financial assistance, offering support during challenging times and helping you meet your financial obligations.

Death Benefits: IPERS provides death benefits to vested members, ensuring financial protection for your loved ones. In the event of your passing, these benefits offer a measure of financial security to your beneficiaries, helping them navigate their financial responsibilities and maintain their well-being.

Participant Wages

When it comes to compensation, it is important to note that IPERS has certain limitations and exclusions. While the IPERS handbook provides comprehensive information on this topic, we will highlight key points to consider.

Covered wages under IPERS encompass various forms of compensation that are eligible for retirement benefits. This includes regular pay, vacation pay, sick pay, overtime, back pay, and amounts deducted from your pay for tax-sheltered annuities, dependent care, and cafeteria plans.

It is worth noting that not all forms of compensation are covered by IPERS. The IPERS handbook, specifically on page 13, provides a reference to other types of compensation that fall outside the scope of IPERS coverage. It is essential to review this section to understand the specific exclusions.

The maximum covered wage is determined by federal law under IRC section 401(a)(17). For the calendar year 2023, the maximum covered wage stands at $330,000. This means that any compensation above this limit is not considered covered wages for IPERS purposes.

To ensure a comprehensive understanding of compensation coverage under IPERS, it is recommended to refer to the IPERS handbook, particularly pages 13, 16, and 17, which provide detailed information on covered wages, exclusions, and the maximum covered wage for the relevant year.

Years of Service in IPERS

For each calendar quarter in which your employer reports covered wages on your behalf (after July 4, 1953), you accrue 0.25 years of service. This means that if your covered wages are reported for a full year, equivalent to four calendar quarters, you earn one year of service credit towards your IPERS benefits.

The accumulation of service credits directly influences the calculation of your IPERS benefits. The more service credits you accumulate, the greater the benefits you are eligible to receive upon retirement. It signifies your length of service and commitment to your employment, which in turn contributes to the overall value of your IPERS benefits package.

By understanding the connection between service credits and IPERS benefits, you can effectively gauge the impact of your employment duration on your future financial well-being.

*IPERS does offer the ability for participants to purchase service credits, with the cost varying for each individual. For individuals with military service, IPERS does offer free service credits that vary across circumstance.

Early Retirement Reduction

The normal retirement age in the IPERS (Iowa Public Employees’ Retirement System) plan is determined by specific criteria. Once you meet these criteria, you can retire without facing any early-retirement reductions. The normal retirement age is determined by the following conditions, and the earliest of these conditions will apply:

Rule of 88: When the sum of your years of service and your age equals or exceeds 88, you are eligible for normal retirement.

Rule of 62/20: If you have 20 or more years of service, you can retire at age 62.

Age 65: You become eligible for normal retirement once you reach the age of 65.

If you do not meet the normal retirement criteria, and you choose to retire early, your benefit amount will be reduced. For each year the benefit is taken early, the benefit amount is reduced by 6% (or 0.5% per month). It is important to note that this reduction applies only to service credits accrued after June 30, 2012.

Early Retirement Reduction Example

When considering retirement under the IPERS plan, individuals who have reached the minimum retirement age of 55 and have accumulated more than 7 years of service face an important decision. They have two options regarding their benefits:

Delayed Benefit until Age 65: If they choose to delay their benefit until they reach the age of 65, they will receive their benefit in full without any reduction.

Early Benefit at Age 55: Alternatively, they can opt to take their benefit at age 55, but with a 60% discount. This reduction is calculated based on a 6% annual reduction multiplied by 10 years of early retirement.

Determining which option yields the greater lifetime benefit depends on several factors. The decision relies on the annual benefit amount associated with each scenario, and it considers the individual’s expected life expectancy.

Careful consideration is crucial to evaluate the long-term financial implications of these choices. Assessing the annual benefit amounts and estimating life expectancy can help individuals make an informed decision regarding when to begin receiving their IPERS benefits which allows them to optimize their retirement income and ensure their financial well-being throughout their retirement years.

It is important to note that individuals may begin taking their benefit at any age between age 55 and 65 with a respective discount applied (6% each year before age 65).

IPERS Benefit Calculation Examples

Below, we will provide three examples that illustrate benefit calculations for participants who meet the requirements for full retirement benefits under the IPERS. These examples demonstrate how benefits can vary based on individual circumstances.

Example 1: IPERS Participant Reaches the Rule of 88

Assumptions:

- Participant starts in IPERS at age 30 (1 year of service at age 31)

- Wages start at $50,000 and grow 2.5% annually until retirement

- The participant becomes vested and eligible for a retirement benefit at age 37 (years of service 7 or greater)

At age 59, the IPERS participant has reached the Rule of 88. They have worked in IPERS covered employment for 29 years (59+29=88).

IPERS calculation

Based on an average of the five highest years’ salary amounting to $97,449.39 and applying the multiplier of 58% for 29 years of service, the calculated annual IPERS benefit would be $56,520.65. This benefit represents the amount that a participant would receive per year from the IPERS (Iowa Public Employees’ Retirement System) plan.

Retiring before reaching the rule of 88, which is the combination of years of service and age equaling or exceeding 88, carries a consequence in the form of a 6% discount for each year of early retirement prior to age 65. This reduction factor is an important consideration for participants contemplating retirement before reaching the specified age threshold.

IPERS Participant Reaches the Rule of 62/20

Assumptions:

- Start IPERS at age 42 (1 year of service at age 43)

- Wages start at $50,000 and grow 2.5% annually until retirement

- The participant becomes vested and eligible for a retirement benefit at age 49 (years of service 7 or greater)

The IPERS participant reaches the Rule of 62/20 at age 62 with 20 years of service at the University of Iowa.

IPERS calculation

In this example, with an average of the five highest years’ salary amounting to $78,030, the multiplier for 20 years of service is 40%. Multiplying the average salary by the multiplier, we find that the IPERS benefit would amount to $31,212.20 per year.

IPERS Participant Reaches age 65

Assumptions:

- Start IPERS at age 35 (1 year of service at age 36)

- Wages start at $50,000 and grow 2.5% annually until leaving the University

- Works at the University for only 10 years. However, fully vested and can start IPERS pension at age 65.

Even with a relatively short tenure of 10 years at the University, this participant has exceeded the requirement for full vesting in the pension plan (7 years of employment) and can begin taking an IPERS benefit at age 65.

IPERS calculation

With an average of the participants five highest years’ salary amounting to $60,957, their annual IPERS benefit is calculated by applying the 20% multiplier for 10 years of service which results in the participant being eligible to receive $12,191.46 annually as their IPERS benefit.

TIAA Defined Contribution Plan

The University of Iowa’s alternative to IPERS is a 403(b) through TIAA. Similar to 401(k)s, 403(b)s are offered to public schools, churches and certain 501(c)(3) tax-exempt organizations. Initially 403(b) plans were restricted to an annuity structure, as a result, they’re also called ‘tax-sheltered annuities’. Only since 1974 have 403(b)s been allowed to invest in mutual funds instead of insurance annuities.

Reminder: IPERS is the default retirement plan for University of Iowa employees. Within the first 60 days of employment, each new employee must pick TIAA if they prefer the define contribution savings plan.

Defined Contribution Plan

The University of Iowa’s 403(b) is a Defined Contribution Plan administered by TIAA, Teachers Insurance and Annuity Association. Andrew Carnegie’s Foundation for the Advancement of Teaching began TIAA in 1918 to fund pensions for professors. Since then, TIAA’s assets under management have grown to over $1 trillion. The University of Iowa plan is one of TIAA’s oldest and largest plans.

A Defined Contribution Plan differs from a pension in terms of asset investment. While IPERS pools both employee and employer contributions and invests the funds across various asset classes, a Defined Contribution account places the investment responsibility on the employee. The ability of the assets to generate retirement income hinges on the chosen investment returns, thus impacting the plan’s success in funding retirement.

It is important to note that Defined Contribution Plans do not offer a loan feature. If participants would like to access their contributions early (before age 59 ½) there is a 10% fee.

TIAA Contributions

If TIAA is selected, monthly contributions to the plan are mandatory. For the first five years of employment, on the first $4,800 income, participants contribute 3.33% and the University contributes 6.66%. On the remaining income, employees contribute 5% and the University of Iowa contributes 10%, a generous contribution compared to alternative employer retirement plans.

After five years employed at the University of Iowa, all income is subject to the mandatory 5% employee contribution which receives the 10% University match. However, not all salaries receive full contribution. The IRS sets a cap on the maximum eligible salary which is currently set at $305,000. For high-income earners at the University of Iowa, there are additional investment vehicles offered through TIAA.

Example: An employee earning $50,000 per year, who has worked for the University of Iowa over five years, will contribute $7,500 in the calendar year ($2,500 or 5% from the employee, and $5,000 or 10% from the employer).

An important difference between TIAA and IPERS contributions is the vesting schedule. In the TIAA 403(b) plan, both the employee and University contributions are fully and

immediately vested. This means if employment ends, all contributions are the employees to maintain at TIAA or rollover.

TIAA Investment Options

Whereas IPERS contributions are pooled and invested across asset classes on behalf of the participants, TIAA enrollees are responsible for optimizing their investment options. A participant can choose between stock and bond mutual funds, as well as target-date funds and a fixed-rate annuity.

The default investment option for new employees is a TIAA target date fund. A target date mutual fund is a type of asset allocation mutual fund where the mix of securities and asset classes, equities, and fixed income gradually shifts as your target date for accessing your funds (usually for retirement) draws closer.

An example at TIAA is the TIAA-CREF Lifecycle Index 2035 Fund. This fund’s target allocation consists of an equity/fixed income mix of approximately 71.70%/28.30%. Over time, the Fund’s target allocations will gradually become more conservative, moving to target allocations of approximately 50.00% equity/50.00% fixed-income in the Fund’s target retirement year of 2035 and reaching a final equity/fixed-income mix of approximately 20.00%/80.00% in 2065.

The default investment option TIAA provides is a sound foundation for participants, but the ability to diversify and re-balance an investment portfolio within TIAA is what makes the defined contribution plan attractive. Each individual’s retirement plan is unique to their circumstances, but the default TIAA asset allocation only considers the target retirement date for the participant.

Unique to the University of Iowa TIAA 403(b) plan, there are robust investment options available. Whereas most investment options in a TIAA plan would be predominately proprietary TIAA funds, the University of Iowa’s plan is expansive. The equity mutual fund options alone total 36 different funds. Here are a few examples:

- Vanguard Institutional Index Fund Institutional

- Vanguard Developed Markets Index Fund Institutional

- Vanguard Small-Cap Index Fund Institutional

- American Funds Capital Income Builder Fund

- Columbia Select Mid Cap Value Fund

- Eaton Vance Large Cap Value

TIAA Traditional

TIAA offers a range of annuity products designed to provide individuals with secure and guaranteed retirement income. These annuity options are intended to help individuals plan for their financial future with confidence. Some of the annuity products offered by TIAA include:

- TIAA Traditional: TIAA’s flagship annuity product, TIAA Traditional, provides a fixed interest rate and a guaranteed return. It offers stability and reliability, with an average credit rate of 4.25% since 2000 (2.5% guaranteed and an additional 1.75% based onTIAA’s performance).

- TIAA Single Premium Immediate Annuity (SPIA): This annuity allows individuals to convert a lump sum of money into a guaranteed income stream that starts immediately. It offers predictable and regular payments for a specified period or for life.

- TIAA Lifetime Income Annuity: With this annuity, individuals can create a guaranteed stream of income that lasts for their entire lifetime. It provides a steady income source that can help cover essential expenses during retirement.

- TIAA Fixed Annuities: TIAA offers fixed annuities that provide a guaranteed interest rate for a specific period. These annuities offer stability and protection from market fluctuations.

- TIAA Variable Annuities: TIAA also offers variable annuities, which allow individuals to invest in a variety of investment options within the annuity. The return on these annuities is based on the performance of the chosen investment options.

These annuity products provide individuals with different options to suit their retirement needs and goals. Whether one seeks a guaranteed income stream, a fixed interest rate, or the potential for market-linked returns, TIAA’s annuity products aim to offer stability, flexibility, and a secure financial future.

Although an attractive option, an allocation to TIAA Traditional does have a large drawback. In periods of higher market returns TIAA Traditional will consistently underperform the market resulting in less-than-optimal returns. TIAA Traditional does offer protection against the market return downside, but from 2000 to 2022 a 60% stocks and 40% bonds portfolio had an annualized return of 7.5%, well above the historical return of 4.25% for an individual invested in TIAA Traditional during that period.

ERISA vs. Non-ERISA Retirement Plans

The Employee Retirement Income Security Act (ERISA), established in 1974, was designed to safeguard workers’ retirement income and promote transparency in retirement plans. While ERISA typically covers Defined Contribution Plans, it does not extend to the retirement plan offered by the University of Iowa. As a non-ERISA retirement plan, participants in the University’s plan do not have access to certain tax benefits and contribution protections that are typically provided by ERISA plans. It is important to note that while the University of Iowa voluntarily offers many of these benefits to participants, they are not obligated to do so under ERISA guidelines, leaving the possibility for policy changes in the future.

Non-ERISA retirement plans, such as individual retirement accounts (IRAs) and simplified employee pension plans (SEPs), offer greater flexibility in terms of plan design and contribution limits. Both employers and employees have more control over the plan features and contribution amounts, allowing for customization to meet specific needs and preferences. In addition to the mandatory Defined Contribution Plan provided by TIAA, the University of Iowa also offers other retirement savings options, including the Voluntary Retirement Savings Plan, the 457(b) Deferred Compensation Plan, and a Supplemental Savings Account, all facilitated by TIAA.

By offering a range of retirement savings plans beyond the mandatory plan, the University of Iowa aims to provide employees with additional avenues for saving and investing for their future. While non-ERISA plans may lack certain regulatory protections, they offer increased flexibility and choice, allowing individuals to tailor their retirement savings strategies to align with their unique financial goals and circumstances.

Voluntary Plan Options | University Human Resources – The University of Iowa (uiowa.edu)

Voluntary Retirement Savings Plan

The University of Iowa’s Voluntary Retirement Savings Plan is available to all eligible employees of the University of Iowa, including faculty and staff members. Participants can contribute a portion of their salary on a pre- or post-tax basis, with pre-tax contributions being deducted from their salary before taxes are applied which offers potential tax advantages by reducing taxable income.

Unlike pre-tax contributions, Roth contributions are taken from your paycheck after taxes are paid and you will owe no taxes on your initial investment or earnings on qualified distributions. You can make Roth contributions, pre-tax contributions, or a combination of the two. Annual IRS contribution limits remain the same regardless of whether you choose pre- tax, Roth, or both.

As a participant in a 403(b)-retirement plan, individuals can access contributions and earnings penalty free once they reach the age 59 ½, subject to certain IRS regulations. The plan offers a range of investment options, such as mutual funds or target-date fund that are similar to the investment options offered in the Defined Contribution Plan. Participants can choose how to allocate their contributions among these options based on their risk tolerance and investment goals. Typically used as a supplement to an individual’s Defined Contribution retirement plan, the maximum annual participant contribution is $22,500 with an additional $7,500 annually in catch-up contributions for those aged 50 and older.

Deferred Compensation Plan 457(b)

For individuals looking to save beyond their Defined Contribution Plan and the Voluntary Retirement Savings Plan, TIAA offers a Deferred Compensation Plan that is similar.

Participants may contribute $22,500 annually with an additional $7,500 as catch-up contributions for those age 50 and older. While similar in structure, it is important to note that the Deferred Compensation Plan is separate from the Voluntary Retirement Savings Plan offered by the University of Iowa. The Deferred Compensation Plan allows participants to defer a portion of their salary for retirement savings beyond the limits of other retirement plans, while the Voluntary Retirement Savings Plan focuses on the ability to make pre-tax contributions within those limits.

Retirement Plan Limits

Retirement Plan Options | University Human Resources – The University of Iowa (uiowa.edu)

Supplemental Savings Account

In addition to the wide range of retirement plans offered by TIAA, individuals have the opportunity to leverage the supplemental savings account to enhance their savings strategy. This account goes beyond TIAA participants, welcoming all individuals interested in enrolling. As of July 2023, the supplemental savings account provided by TIAA offers an enticing option for individuals with shorter time horizons for capital allocation. By depositing funds into this account, participants can benefit from an attractive 4.5% annual percent yield, which provides the potential for respectable returns while maintaining flexibility and accessibility to their funds.

The supplemental savings account serves as a valuable tool for individuals with financial goals beyond retirement planning. Whether saving for specific milestones, building an emergency fund, or pursuing other financial objectives, this account enables individuals to maximize the potential of their savings through the offered interest rate.

The flexibility offered by the supplemental savings account is particularly beneficial for individuals who have shorter investment time horizons. It allows them to take advantage of the attractive interest rate while maintaining liquidity, which is crucial for addressing unexpected expenses or seizing other investment opportunities that may arise.

TIAA Enrollment

To ensure effective management of your participation in TIAA, it is recommended to complete your beneficiary designation online via the official TIAA website. This platform provides a wealth of information about the investment options available, allowing you to allocate your retirement funds across a diverse range of investment choices. It empowers you to make informed decisions and customize your investment strategy based on your risk tolerance, time horizon, and financial goals.

Notably, the University of Iowa offers a distinctive benefit where participants have the opportunity to engage a financial advisor who can assist in strategically allocating and advising on their TIAA retirement accounts. Collaborating with a financial advisor provides personalized guidance tailored to your specific needs and circumstances. They can help you assess your retirement goals, select appropriate investment options, and monitor your progress over time. This valuable support can enhance your confidence in making retirement- related decisions and ensure that your savings align with your long-term objectives.

By taking advantage of the products, flexibility, and resources offered by TIAA, individuals can proactively manage their retirement accounts, maximize the benefits they offer, and work towards a secure and confident future. Whether through the Defined Contribution, Voluntary Retirement Savings, Deferred Compensation, or Supplemental Savings account, TIAA provides the tools and support needed to make informed decisions, optimize investment strategies, and achieve long-term financial objectives.

IPERS or TIAA: Which is the Right Choice for You?

Throughout our discussion, we have highlighted the benefits of the retirement plans offered to University of Iowa employees, including IPERS and TIAA. However, it is equally important to consider the potential drawbacks of these plans in order to make informed decisions and optimize savings for a confident retirement.

Why not IPERS?

While IPERS (Iowa Public Employees’ Retirement System) offers certain benefits, there are several factors to consider before committing to the program:

- Vesting: IPERS provides benefits to its members even if they are not vested. However, being vested ensures that you receive a portion of your employer’s contributions and interest if you leave covered employment. The vesting calculation is based on dividing your years of service by 30 (or 22 for Special Service). If you are not planning to stay in covered employment long enough to become vested, you may not fully benefit from IPERS.

- Leaving IPERS before retirement: If you leave IPERS-covered employment before retirement, you have several options. You can leave your contributions in IPERS, where they will continue to accrue interest until you apply for retirement benefits, return to covered employment, or request a refund. However, it’s important to note that IPERS does not adjust for inflation, so the value of your contributions may be impacted over time.

- Minimum years in IPERS: It is worth considering the minimum number of years in IPERS that make financial sense for you. You may want to evaluate the breakeven point compared to other retirement options like TIAA. For example, if you work in IPERS for 20 years and then start receiving benefits at age 62, you need to assess whether this timeline aligns with your retirement goals and if the benefits outweigh other potential options.

- Income replacement and inflation: IPERS may not provide full income replacement in retirement, especially if you have a shorter tenure in the program. It is essential to have additional sources of savings or investments to supplement your retirement income. Additionally, since IPERS does not adjust for inflation, it is crucial to consider the potential impact of inflation on the purchasing power of your benefits over time.

While IPERS offers benefits to its members, it is important to carefully assess factors such as vesting, leaving before retirement, the minimum years required for a sensible investment, income replacement, and inflation adjustments. Evaluating these aspects will help you determine whether IPERS aligns with your long-term retirement goals and if other retirement options like TIAA may better suit your needs.

Why not TIAA?

TIAA provides the flexibility for participants to utilize multiple retirement savings plans that best serve their needs, and enables individuals who do not plan to be in their role for the long-term to capitalize on the contributions they make and the employer match they receive even if they leave after a short tenure. While TIAA provides additional flexibility, there are several factors to consider before committing to the program:

- Non-ERISA retirement plan: Unlike typical retirement plans covered under the Employee Retirement Income Security Act (ERISA), the University of Iowa’s TIAA retirement plan is not covered by ERISA. This means participants may not receive certain tax benefits and contribution protections that are offered by ERISA retirement plans. The university may have more flexibility to change policies related to the retirement plan without following ERISA guidelines.

- Potential policy changes: As a non-ERISA retirement plan, the University of Iowa’s TIAA plan may be subject to policy changes that could impact participants. While the university currently provides many benefits on its own accord, it retains the ability to modify policies at any time, which could potentially affect the terms and conditions of the retirement plan.

- Limited tax benefits: Participants in the TIAA retirement plan at the University of Iowa may miss out on certain tax advantages available in ERISA-covered plans. These tax benefits can include deductions for contributions, tax-deferred growth, and potential tax savings upon withdrawal. It is important to consider the impact of these limitations on your overall retirement strategy and tax planning.

- Contribution limits: While non-ERISA retirement plans like TIAA offer greater flexibility in plan design and contribution limits, there may still be certain restrictions on the amount of contributions participants can make. It is essential to understand and evaluate the contribution limits imposed by the TIAA plan at the University of Iowa to ensure they align with your savings goals and retirement needs.

- Dependency on university policies: Since the University of Iowa provides retirement benefits through TIAA, participants are reliant on the university’s commitment to offering and maintaining those benefits. Changes in university policies or financial circumstances could potentially impact the availability or terms of the TIAA retirement plan.

In summary, the drawbacks of the TIAA retirement plan at the University of Iowa include its non-ERISA status, potential policy changes, limited tax benefits, contribution limits, and dependence on the university’s commitment to the plan. It is important for participants to thoroughly understand these drawbacks and consider them in conjunction with their individual retirement goals and preferences.

We will now present scenarios that highlight the optimal retirement plan for participants considering IPERS or TIAA at the University of Iowa.

Scenario #1 – Participant works at University of Iowa until age 60

Assumptions:

- Begins working at the University of Iowa at age 25

- Participant earns $50,000 in year 1

- We grow wages by 2.5% each year

If an individual enrolls in IPERS and works under covered employment until age 60, the net present value of the participants IPERS benefit at age 60 will be:

This value represents the present value of the annual cash flows of the IPERS benefit ($72,327) from age 60 until age 90, using a 3% discount rate. By discounting the future cash flows, we can determine the true value of all the future IPERS benefits, considering that the cash flows remain the same every year indefinitely, rather than receiving a lump sum at retirement that can be invested.

If an individual enrolls in TIAA and works under covered employment until age 60, the value of the participants TIAA investment account at age 60 assuming 7% annualized return will be:

It is important to note that the hurdle rate for TIAA to be more beneficial than IPERS in this scenario is 7%. To achieve that annualized return from age 25 to age 60, the participant needs to have the tolerance to take on significant risk with their investments year-over-year until retirement.

*TIAA is subject to greater investment risk with the participant invested entirely in the public market, while IPERS is subject to greater longevity risk with the present value in retirement being significantly lower if the participant does not reach the rule of 88.

Scenario #2 – Participant works at University of Iowa for 7 years

Assumptions:

- Begins working at the University of Iowa at age 25

- Participant earns $50,000 in year 1

- We grow wages by 2.5% each year

- Participant works at the University of Iowa for 7 years until age 32

Due to the IPERS retirement eligibility criteria, the participant will need to wait until they reach the age of 65 to start receiving their retirement benefits, even though they stop working at the age of 32. On the other hand, the TIAA participant will not make any further contributions after completing 7 years of employment, but their existing contributions will continue to grow annually by 7% until they reach the age of 65.

If we assume a 7% annual return on the assets invested at TIAA, the participant would have the following present value for IPERS and account value at TIAA at age 65.

In order for IPERS to be more beneficial to the participant under these circumstances, the annualized rate of return for an invested TIAA portfolio would need to be 2% or less. Even though the IPERS participant worked at the University of Iowa until they were vested, the decades of returns in the TIAA portfolio will create a value that far outpaces the IPERS retirement benefit assuming returns are close to historical averages.

Scenario #3 – Participant works at University of Iowa for 15 years

Assumptions:

- Begins working at the University of Iowa at age 25

- Participant earns $50,000 in year 1

- We grow wages by 2.5% each year

- Participant works at the University of Iowa for 15 years until age 40

Similar to the previous scenario, the IPERS participant will need to wait until they reach the age of 65 to start receiving their retirement benefits, even though they stop working at the age of 41. The TIAA participant will not make any further contributions after completing 15 years of employment, but their existing contributions will continue to grow annually by 7% until they reach the age of 65.

If we assume a 7% annual return on the assets invested at TIAA, the participant would have the following present value for IPERS and account value at TIAA at age 65.

To optimize the benefits of IPERS for the participant in this specific scenario, it would be advantageous if the annualized rate of return for the invested TIAA portfolio remains at 2.75% or lower. While it is notable that the IPERS participant’s present value at retirement doubled by working for 15 years instead of 7 at the University of Iowa, it is crucial to recognize that the portfolio value for the IPERS participant also doubled during that period.

While the IPERS retirement system offers a solid foundation, the participant must weigh the potential advantages of continued employment and potential returns within the TIAA portfolio against the benefits provided by IPERS. It becomes a delicate balance between risk and reward, as well as an assessment of individual financial goals and risk tolerance.

Careful evaluation of these factors, along with a thorough understanding of the projected time horizon for employment, will empower the participant to make an informed decision regarding whether IPERS or a TIAA portfolio is better suited to their individual circumstances and desired retirement outcomes.

In our final analysis, we will determine the age at which a participant would need to work at the University of Iowa in order to financially justify choosing IPERS over TIAA as their retirement option.

Assumptions Needed to Justify IPERS instead of TIAA

To justify selecting IPERS over TIAA as an employer-sponsored retirement plan, participants must meet the following criteria:

- Commitment to IPERS: The participant intends to remain employed under IPERS until retirement. This ensures they can fully utilize the benefits offered by IPERS throughout their working years.

- Early Enrollment: The participant joins IPERS at an age that allows them to reach the rule of 88 before turning 65. This rule signifies that the participant’s age and years of service combined must equal at least 88 in order to be eligible for retirement benefits.

It’s important to note that each year a participant receives full retirement benefits before age 65 (full retirement age without the rule of 88 or 62/20) the present value of their IPERS benefit is increased. However, choosing TIAA introduces the compounding returns factor, which affects the benefits if the participant decides to retire earlier than anticipated.

TIAA vs IPERS – A Comprehensive Evaluation of Retirement Options

When considering the rate of return within the TIAA portfolio and its impact on retirement planning, it becomes evident that the decision between IPERS and TIAA is multifaceted and requires a thorough analysis. While both options present their own merits, reaching the rule of 88 in IPERS holds significant advantages for individuals who plan to dedicate their entire career to the University of Iowa.

A key differentiation between IPERS and TIAA lies in the risks associated with each. IPERS participants are shielded from the market risks inherent in TIAA, as they are exposed to legislative and longevity risks linked to a state-funded pension program. The stability and predictability of IPERS can provide peace of mind for individuals concerned about market fluctuations affecting their retirement savings. It is worth noting that IPERS participants often choose to allocate a portion of their benefit to provide for a surviving spouse in the unfortunate event of their own passing. However, this decision results in a reduced benefit for the participant during their retirement years, which should be carefully considered when weighing the options.

These scenarios effectively exemplify the power of compound investing and underscore the benefits of allowing a portfolio to grow over several decades. By giving investments sufficient time to grow, individuals stand to gain significantly higher returns in the long run. The compounding effect can amplify the growth of investments, generating substantial wealth over time. Nevertheless, it is important to emphasize that these illustrations assume an annualized growth rate of 7%, which is a reasonable estimate based on historical market performance. However, it is crucial to acknowledge the potential risk of underperformance in the years preceding retirement, which could substantially diminish the value of an individual’s investments upon reaching retirement age. It is always wise to consider the potential for market volatility and adjust investment strategies accordingly to mitigate risks.

Conversely, those years preceding retirement also present the opportunity for greater returns, introducing a level of volatility with the potential for both positive and negative outcomes. While volatility can be unsettling, it is important to view it as an inherent part of investing. The ability to weather short-term fluctuations and maintain a long-term perspective is key to reaping the benefits of market growth.

Ultimately, the decision-making process between IPERS and TIAA hinges upon several individual factors. Evaluating risk capacity, risk tolerance, and the projected duration of employment at the University of Iowa are key considerations in making an informed choice. Risk capacity refers to an individual’s ability to withstand potential losses and recover from setbacks, while risk tolerance refers to an individual’s comfort level with market fluctuations and investment risk. By carefully analyzing these elements, individuals can chart a course that aligns with their unique financial circumstances and retirement goals, ensuring the selection of the most suitable retirement plan for their needs.

Contact Midwestern Financial Group to optimize your retirement plan today – Midwestern Financial Group in Iowa City – Call Now