Most Americans do not enjoy the pain of saving money. The emotional reward of spending is too great to overcome. As a result, we believe individuals need both a refined process and a little coaching to make the task of saving for college as easy as possible.

SO, IF YOU WANT TO SAVE FOR YOUR CHILD’S COLLEGE, HERE ARE THREE STEPS TO MAKING THE WHOLE THING EASIER:

1. EDUCATE

2. AUTOMATE

3. RECALIBRATE

In a recent blog post, we provided figures for how much college could cost in 18 years – click here if you’d like to revisit that article.

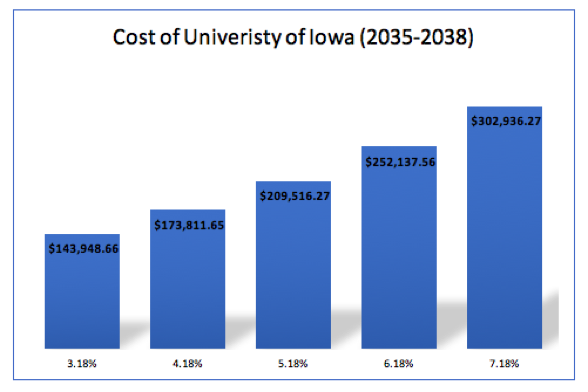

If we use the cost of college today, $19,533 per year, and forecast a 5.18% annual increase in tuition (growth rate), the cost of a four-year degree at the University of Iowa in 18 years is projected to be: $209,516.27.

In the figure above, we are using assumptions in the growth rate. Let’s look at a range of possible tuition growth rates in the below chart.

With the range of possible college cost growth rates, the cost of a four-year degree from the University of Iowa can range from $143,948.66 to $302,936.27

The monthly savings needed to fund that amount in 18 years, assuming 6% growth, is $479 per month. For college savers, given the amount of savings needed, the account type should be optimized, limiting opportunity costs.

WHAT ACCOUNT TYPE SHOULD YOU USE FOR COLLEGE SAVINGS?

Generally, as a parent, aunt, cousin, uncle, grandparent or friend, you have five ways to pay for postsecondary education:

1. Save into a Roth IRA and withdraw contributions later without penalty

2. Save into a taxable account (checking, saving, individual or joint account)

3. Pay for school out of normal monthly cash flows (wages, salary)

4. Pay for school with home equity debt or federal loans

5. OR put money into a 529 and withdraw for education tax-free

WE’LL FOCUS ON #5, UTILIZING A 529. IN OUR OPINION, THIS IS OFTEN THE BEST OPTION. HERE ARE THE BENEFITS:

1. Investments grow tax-free

a. Instead of paying taxes on earnings, dividends or interest in a taxable account, all earnings and income generated in a 529 account are tax-free.

b. The tax deferral enhances the benefits of compound interest. Compound interest is the financial terminology of making interest on your interest.

- Saving $479 per month for 18 years results in an ending portfolio value of $209,516.27. How much of that total are actual contributions? $103,464. Less than half the ending portfolio balance are contributions. The rest of the amount is growth, taking advantage of compound interest. Start early.

2. State income tax deduction (in Iowa)

a. For Iowa residents, contributions to the College Savings Iowa 529 plan are tax deductible at the state level.

b. The tax-deductible contribution amount is $3,329 per beneficiary account. So, if you and your spouse each contribute $3,329 in separate 529 accounts for Johnny, you can deduct $6,658 off your State of Iowa income tax return.

3. Withdrawals are tax-free if used for education

a. You will not pay taxes on money withdrawn from your College Savings Iowa 529 account if the funds are used to cover qualified higher-education expenses.

b. In contrast 401(k) are also tax-deferred vehicles. The participant contributes a percentage of their wages, these grow in the account without taxes paid on the earnings and interest. However, when the participant withdrawals the money from the 401(k), they are responsible for paying income taxes on the distribution. This is not the case for 529s.

4. Relatively flexible with change in circumstances

a. You might be thinking that not all children will go to college or trade school. But, you can change the beneficiary at any time. If Johnny doesn’t need the 529 monies because he received a scholarship or he does not want to go to college, the beneficiary can be changed to his younger sister Mary, a grandchild, or anyone else.

b. If withdrawals are not used for higher-education expenses, there is a 10 percent penalty in addition to income taxes.

AUTOMATING TO OPTIMIZE

When I was in college my grandma would say, “You don’t come to visit enough. We’re out of sight and out of mind.” As usual, she was right. It’s not that I didn’t like to see her, it’s that I didn’t see her, so I didn’t think about it.

The first step to a successful savings plan is automatic contributions. Do you think you’d have as much in your 401(k) if your employer did not automatically take it out of your paycheck?

The State of Iowa’s College Savings Iowa 529 plan is engineered to help savers achieve the best outcomes.

During the account setup process, the account holder can AUTOMATE monthly contributions directly from their checking or savings. The direct deposit option eliminates the step of writing a check and thereby, increasing the likelihood of missing a contribution or two.

ALSO, College Savings Iowa offers age-based investment options. As the child gets older, the investment allocation becomes more conservative given the target goal is closer. For a majority of people, our emotional reactions to money get in the way of our goals. Many avoid making the hard decision and some allow their overconfidence to determine whether they should be invested in the stock market.

The AUTOMATION removes the emotions from the account holder’s investment decisions. Let the plan automatically change the allocation. If you suffer from emotional biases such as overconfidence and illusion of control, do not let them keep little Johnny or Mary from benefiting from compound interest.

MOVING FORWARD

Now that you’ve set up your 529 and automated your contributions, the only thing left is to reassess your savings each year.

Each year market returns become reality, not hypotheticals. Thus, each year we have to recalibrate: reassess contributions necessary to fund the future liability of college. Part III of this series will cover the discussion of recalibration.