UNTHINKABLE EVENTS HAPPEN

In our complex world, incidents happen we do not expect. Most of us have experienced an unexpected event, perhaps the loss of a job or something within our home, car or health going awry.

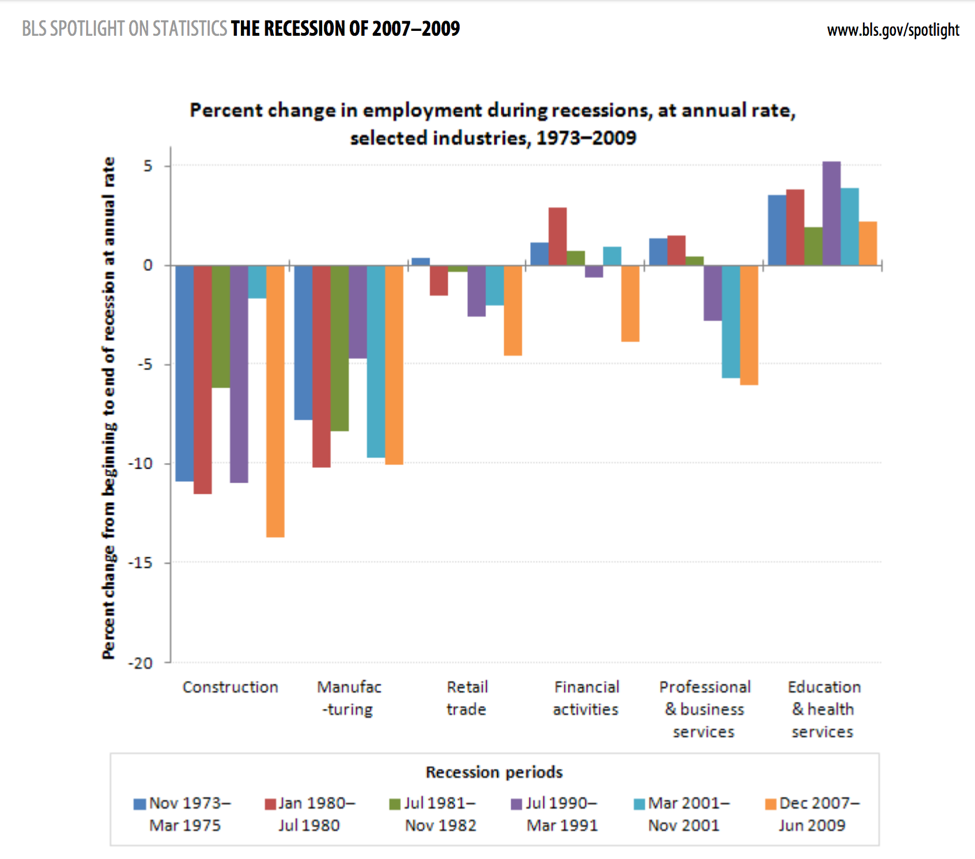

Consider struggles with the job market a few years back. From the beginning of 2009 to February 2010, the U.S. labor market lost 8.8 million jobs and in 2009, the unemployment rate peaked at 10 percent.

To make matters worse, if you lost your job, it became difficult to find a new one. Job openings were 4.8 million in March 2007 and during the recession the number of job openings fell 44 percent, despite “only” a five-percent decline in employment over the same period. In July 2009, the number of job openings bottomed at 2.1 million, an over 50 percent cut from two years prior.

If you own your home or auto, you also know unexpected bills can pile up in these categories as well. Regular maintenance helps, but aging homes and automobiles begin to break down and for many, fixing the problem is the optimal solution (versus trading it in or moving).

Let’s take an air conditioner, for example. Below you’ll find an estimated replacement cost according to Home Advisor.

Do you have the emergency savings to cover a replacement air conditioner? Do you have the emergency savings to cover your fixed expenses if you lost your job?

STARTING AN EMERGENCY SAVINGS

The point of an emergency savings is to avoid taking on debt. If the unthinkable happens, you want to be able to pay for repairs or cover your fixed expenses without having to use a line of credit from your home, or worse, credit cards. Both options come with interest, but more importantly, a monthly payment you do not need in your current time of emergency. Liquid savings cushions the blow and allow for time to heal the wound. Unfortunately, Americans are not good at saving for emergencies despite being good at growing credit card debt. According to Go Banking Rate, more than half of Americans have less than $1,000 in savings in 2017.

So, how do you start saving?

A general rule of thumb is to keep up to six months of income in liquid savings, by liquid I mean in a savings account, not invested in securities that you have to sell in order to get your money. However, this rule of thumb should be adjusted based on your specific circumstances. Are you debt free? If so, you probably need less liquid savings. Why? You don’t have any fixed debt payments; the only expenses to cover in the event you lost your job would be variable items such as gas, groceries, and entertainment and fixed items such as insurance. If your household has debt, which may include credit cards, a mortgage or student loans you potentially have large fixed payments your household would need to cover even if someone lost a job. You do not want to be in a position to cover your debt payments in a time of crisis with debt (credit cards). If you have children, this equation becomes even more complicated with daycare, healthcare and activities.

All of these circumstances are individual or household specific. Thus, the first place to start is with a budget. Start tracking where you spend your money and how much you spend. Once you’ve tracked your spending for a few months, you can better gauge the appropriate amount of emergency savings.

I use Mint and Pat uses Personal Capital. Both are great services to track household spending. If phone and web applications are not your thing, you can use Google, budget templates or one of the many spreadsheet options available online.

KEEP IN MIND:

1. You need liquid savings. The amount necessary is subjective, but if you do not have some, you need to do something about it.

2. You will get in your way. If you do not have the habit of saving today, it will be difficult to get started and maintain. Do not let that discourage you. Keep working at it.

3. The best way to overcome this is automation. Set up a savings account at another bank and send money there every month. Do not look at it, or touch it. Automate your saving and then forget about it.