FOR BUSINESS OWNERS, OFTEN THEIR WEALTH IS DERIVED ENTIRELY FROM THEIR BUSINESS. THEIR BUSINESS PAYS FOR THEIR LIVING EXPENSES AND WILL OFTEN FUND THEIR RETIREMENT. THUS, IT IS CRITICAL BUSINESS OWNERS UNDERSTAND HOW THEIR BUSINESS IS VALUED AND THE UNDERLYING VALUE DRIVERS. THIS BLOG POST ONLY SCRATCHES THE SURFACE, BUT PROVIDES A SIMPLE FRAMEWORK TO STRUCTURE BUSINESS DECISIONS.

The value of an asset is largely derived from the amount of cash it produces. The cash produced is called ‘free cash flow’ (FCF). Free cash flow is the cash an investment generates after laying out the money required to maintain or expand its asset base, also knows as capital expenditures. Cash flow provided by the investment allows other opportunities to be explored that can generate more cash flow.

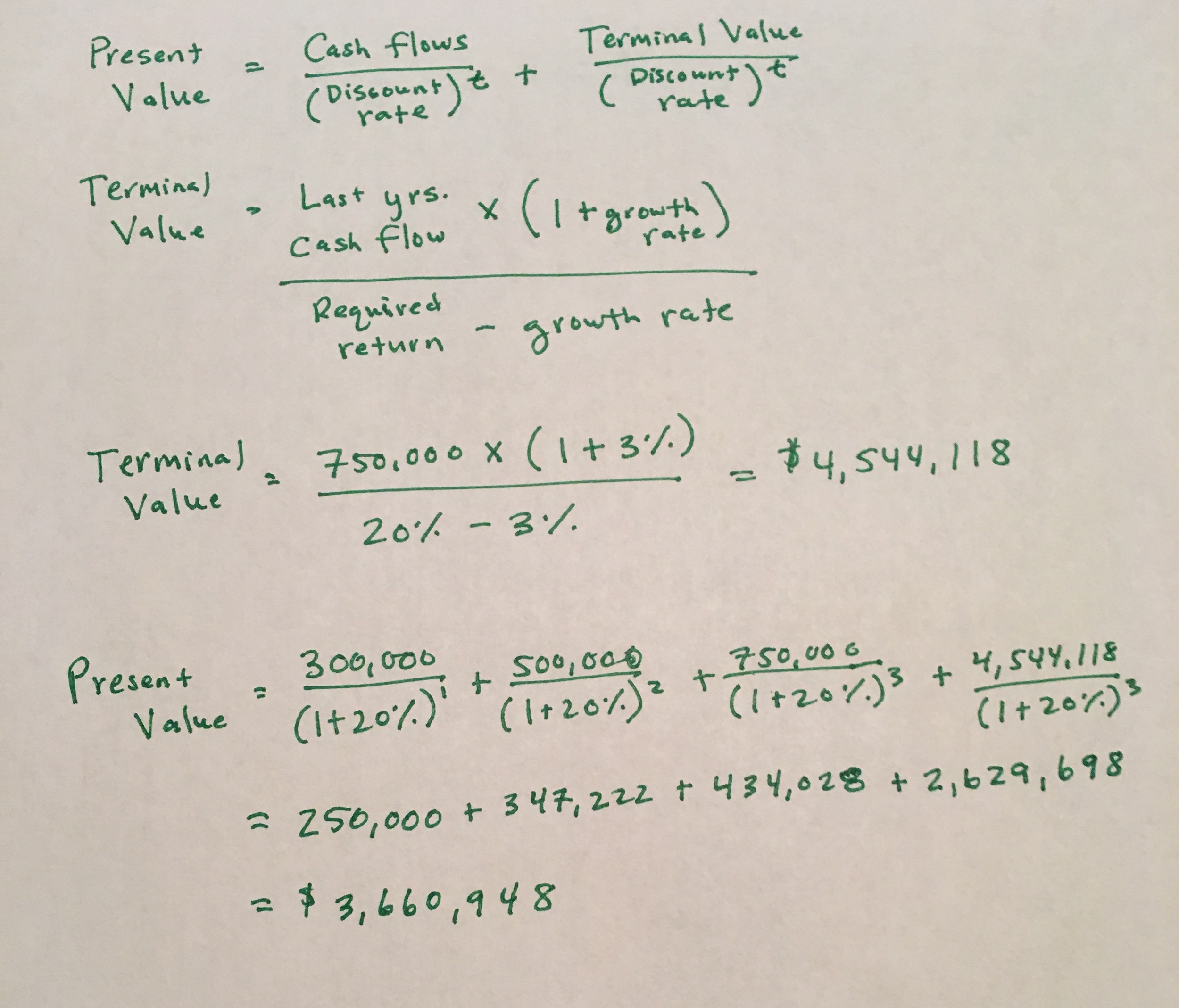

The amount of FCF an investment generates is used to determine the investment’s value. To determine this value, add the cash distributed today with the expected cash distributed in the future and discount the cash flows to today’s dollars. In short, the value of an asset is determined by the calculated cash flow and the discount rate used to value future cash flows according to today’s dollar terms.

HERE’S AN EXAMPLE:

Jim owns a small manufacturing business that sells $1 million of nails each year and earns a profit of $250,000 annually. Jim plans to expand his operation and over the course of three years double his profits each year. After adjustments, his cash flow generated is expected to be $300,000, $500,000 and $750,000 for Years One, Two and Three, respectively. Beyond those three years Jim expects his cash flow to grow by three percent annually in perpetuity.

An investor is interested in buying Jim’s business, but she requires a 20 percent rate of return meaning that over a certain period of time (most likely one year), she is expecting to see a 20 percent growth on her investment. If that is the case, how much is she willing to pay Jim for his nail-manufacturing business?

Assuming a 20 percent required rate of return, the cash flows presented and three-percent growth in perpetuity, Jim’s business is worth at least $3,660,948 to her. If she already owns a similar business and would be able to cut costs through synergy, the value to her may be even more.

As a business owner attempting to determine the value of your company, or as an owner of cash producing assets, answer these questions:

- What are my projected cash flows?

- How can I maximize my cash flows?

- What is the appropriate required rate of return?

- What steps can I take to minimize the required rate of return of a buyer?