Since the Great Recession, U.S. companies have used cheap debt, stock buybacks and minimal capital expenditures to boost profit margins. It was a slow, methodical attempt to remain relevant among growing threats of new entrants from Silicon Valley while maintaining happy shareholders. It was the long game, similar to avoiding fad diets and losing weight through diet and exercise.

But in March 2020, corporate America threw away the long game of diet and exercise and opted for gastric bypass surgery. Why the slow, methodical drain of losing 5 pounds a year when you can lose 65 percent of your body weight in the first year?

Right now, corporations are pulling forward investments in technology and implementation of tactical business decisions. And the stock market is betting on which companies will win and which will lose.

A Look Under The Hood

Today is the last day of the second quarter. On April 1, the S&P 500 opened at 2,498.08 after falling from 3,244.67 at the start of the year. As of the opening today, the S&P 500 rallied to 3,053.24, a 22.2% jump in the second quarter. The S&P 500 is positive 3.79% since June 29, 2019.

The S&P 500 is positive 3.79% since June 29, 2019. This is in the middle of a global pandemic.

Although the headline, “The S&P 500 is up 39% from the intra-day bottom” is stunning, the returns below the surface are mind-blowing.

1-year returns for sectors as of June 29, 2020 (Fidelity):

Biggest sector losers

• Energy Equipment and Services: down 52.66%

• Diversified Consumer Services: down 51.51%

• Airlines: down 47.53%

• Leisure Products: down 30.18%

• Banks: down 25.81%

• Hotels, Restaurants and Leisure: down 21.52%

Biggest sector winners

• Technology, Hardware, Storage and Peripherals: up 71.85%

• Software: up 39.66%

• Internet and Direct Marketing Retail: up 34.74%

• Semiconductors and Semiconductor Equipment: up 32.07%

• Biotechnology: up 28.60%

• Trading Companies and Distributors: up 20.01%

• Health Care Providers and Services: up 11.84%

The Stock Market Is Predicting The Future

At the end of 2019, the value of all U.S.-based companies listed on stock exchanges was nearly $38 trillion. That’s $38 trillion worth of reasons to predict the future correctly. In the face of status quo bias and driven by loss aversion, predicting the future is something the stock market does well.

Mr. Market is pondering these questions:

• If more American work from home, how much will business travel decrease?

• Do airlines have too much capacity? What about hotels?

• With less flights and less travel in the car to and from work, what is the decline in demand for oil?

• If more Americans work from home, how many restaurants are needed to support the professional class from 12-1 PM?

• Given the recent necessity to shop online, will consumers go back to the malls?

• If not, how much more advertising revenue can Facebook and Google collect?

• How much money will corporate America need to spend on technology in order to support remote employees?

• What are the repercussions on office real estate?

So, its no surprise to see stocks like Zoom and Shopify rally higher (ignoring valuation for now). Online e-commerce was going to grow over the next decade, with or without COVID-19, but COVID-19 increased the speed of transformation. Here are two examples of growth being pulled forward (aka revenue that would have been made in 2023 is now happening in 2020):

Graphics via Octahedron Capital

Lastly, here are two year-to-date stock charts. There first is Jones Lang LaSalle, a giant real estate company. They recently published a report, “The Future of Office Demand” which concluded that physical office will continue to facilitate innovation, collaboration and employee health, well-being and productivity. Investors aren’t buying it, as of now.

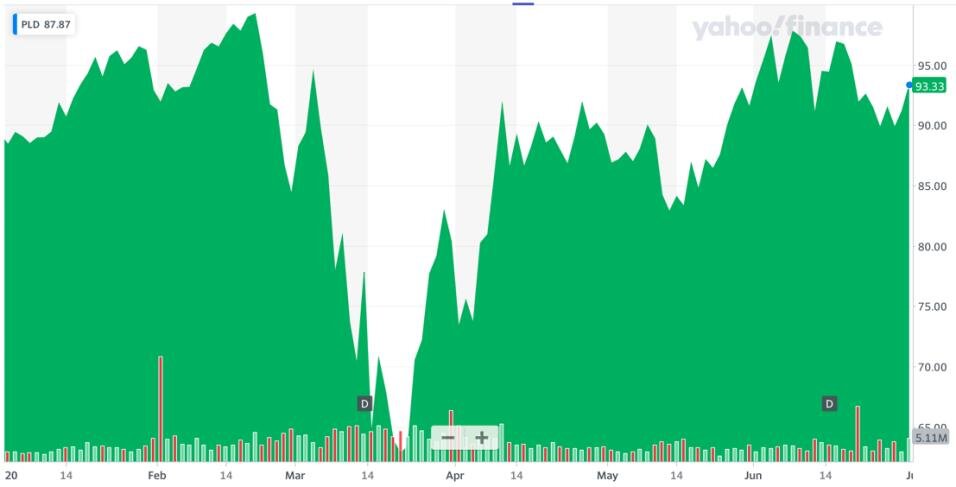

The second chart is Prologis. Prologis is a real estate company that specializes in two major categories: business-to-business and retail/online fulfillment. Prologis has also released recent research, Accelerated Retail Evolution Could Bolster Demand for Well-Located Logistics Space, and investors are supporitive of their position.

Allocation Ramifications

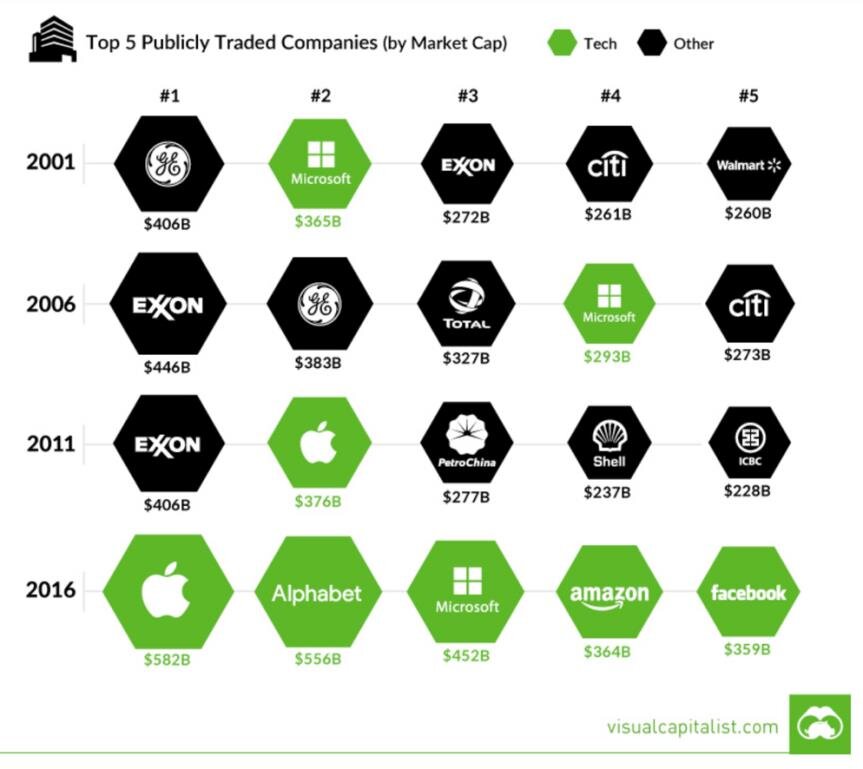

Luckily for everyday investors, sector weights and determining the winners and losers of accelerating trends is unnecessary. There is no reason to attempt to pick the winners and losers in the future economy. Market participants will vote with their money and the value of the underlying companies will adjust to their revenue and profit opportunities. Owning the broad S&P 500 will naturally adapt a portfolio overtime, increasing the value of companies that have the most future potential. The chart below shows the top five largest companies in different years over the last few decades.

In 2001, General Electric was the most valuable company in the world at $406 billion. Today, GE is worth $59 billion.

At MFG our focus is on broader asset allocation. Given your goals and risk tolerance, what is the appropriate percentage of stocks/bond/international stocks/high-yield bonds/gold/etc. in your portfolio?